Did you know that according to Part 2, Article 6 of the New Hampshire Constitution:

“... there shall be a valuation of the estates within the state taken anew once in every five years, at least, and as much oftener as the general court shall order”

This basically is an article built-in to protect the property owners of New Hampshire. That means at least every 5 years the party responsible for assessing taxes (in this case the Town of Barrington’s Assessing Office) is legally required to reassess the properties in the town.

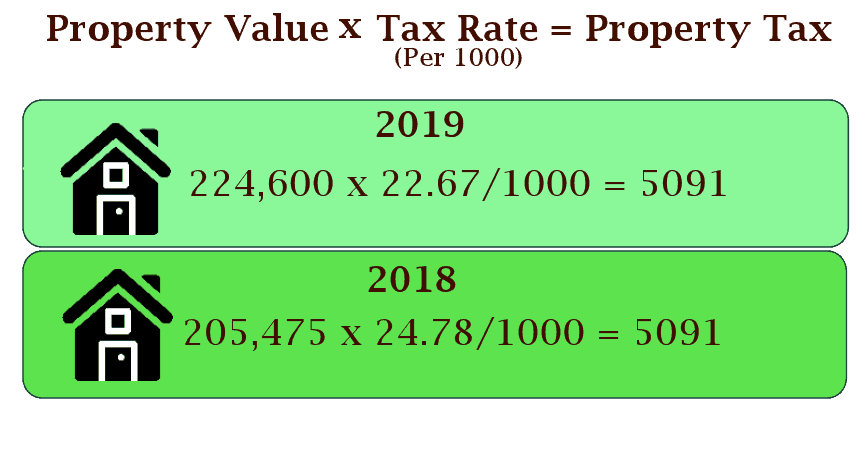

Many people are concerned with a property reassessment because they feel the value of their properties will most likely increase. However, this year our tax rate decreased, which may actually result in a tax decrease for some people. The property tax is calculated in the following manner:

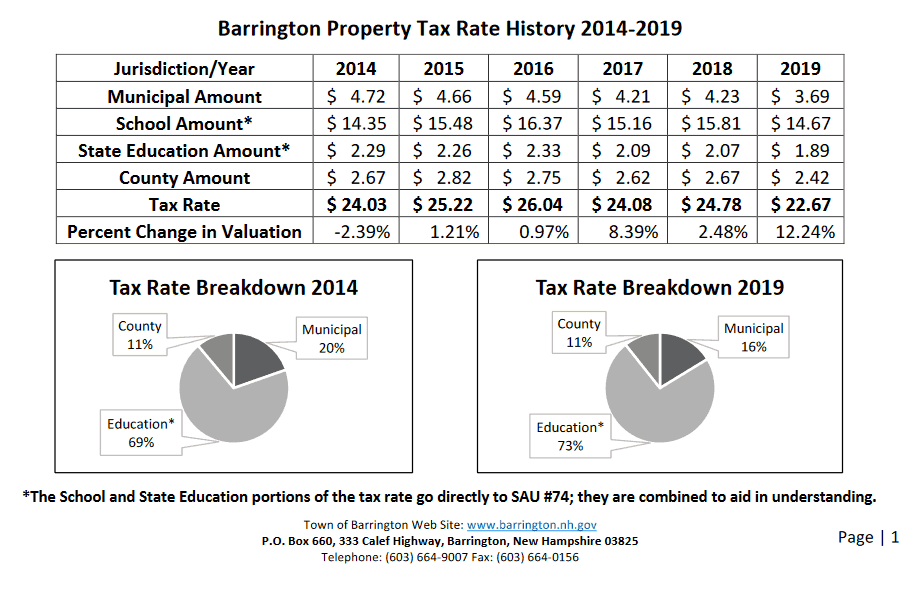

This year’s (2019) tax rate is the lowest in 6 years. The valuation of the town, however, has increased by almost 10% compared to last year. The average single homes have increased an average of 12%. The valuations are a reflection of the current real estate market. More affordable properties are in higher demand, which increased sales prices and resulted in higher fair market value. This may result in a property tax increase for some people. However, their homes are worth more on the current market. Our town’s property tax rate is comprised of several different elements, as seen on the town website:

If there is a problem with the assessment that was made, the property owner can follow the normal abatement and appeal process by contacting the Assessment office in town. There are Property Tax Exemptions, Credits and other property tax reductions available in the Town of Barrington:

· Current Use (for parcels larger than 10 acres)

· All Veteran’s Credit ($450)

· Surviving Spouse Credit ($2,000)

· Service-Connected Total Disability Credit ($2,000)

· Elderly Exemption ($85,000-$161,500 depending on age)

o Income Limit

§ Single $30,000

§ Married $50,000

o Asset Limit (does not include residence)

§ Single/Married $125,000

· Disabled Exemption ($50,000)

o Income Limit

§ Single $30,000

§ Married $50,000

o Asset Limit (does not include residence)

§ Single/Married $75,000

· Blind Exemption ($15,000)

· Solar Exemption ($5,000)

How do I find out the current valuation of my home?

https://www.axisgis.com/BarringtonNH/

Online Property Tax Calculator*

Based on your property’s valuation, the tax calculator figures out an estimate for you. Please note, the tax bill insert shows a lower rate ($22.67) than the online calculator is using ($24.78).

https://www.barrington.nh.gov/assessing-office/pages/online-property-tax-worksheet

More about Property Tax Assessments https://www.barrington.nh.gov/sites/barringtonnh/files/uploads/dra_present_assessing_101_web.pdf

What our last Tax Bill Insert Said:

https://www.barrington.nh.gov/sites/barringtonnh/files/uploads/2019_tax_bill_insert_-_191105.pdf

2019 Revaluation FAQ https://www.barrington.nh.gov/sites/barringtonnh/files/uploads/revalfaq.pdf