The Barrington Town Administrator, Connor MacIver, had some clarifications regarding the recent article entitled, “Private Road Taxpayers Being Unfairly Assessed?” The article was published mainly because Dover residents have a very different process that they go through in their property assessments, and there were Barrington residents that had attended a meeting in Dover about Private Road Taxes, in addition to the Foster’s not covering the story.

Town Administrator MacIver stated in an email:

“State law, the NH Department of Revenue Administration, and the Board of Tax and Land Appeals only require that assessors achieve fair market value with assessments. The assessing methods used vary significantly from community to community. It is important that the method used is consistent within a community in order to facilitate equitable taxation. Between communities the methods can be different, and the state equalizes the values (for reporting purposes) accordingly (using sale data). The fact that assessing methods vary between Barrington and Dover is not at all surprising and does not make one method better or worse; they are just different. The goal of the methods is still the same, to arrive at a fair market value assessment. It is unproductive to pit one community’s assessing methods against another.”

He went on to state:

“The information I provided regarding Barrington’s assessing methods is factual. The article presents the description of these methods as a debatable opinion (using terms like ‘claims’). If you had concerns that the information I was sharing was inaccurate, you simply had to ask for examples. I will provide the following examples (see corresponding land assessment data images, attached):”

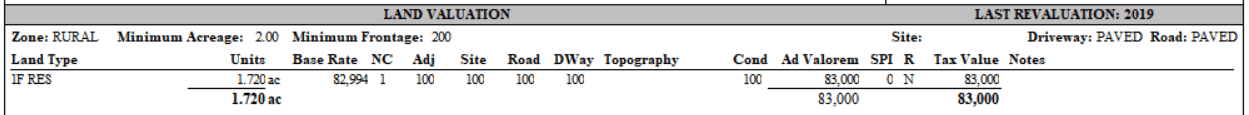

Class V – Paved – Brooks Road

Base $82,994; Assessment $83,000: 0%

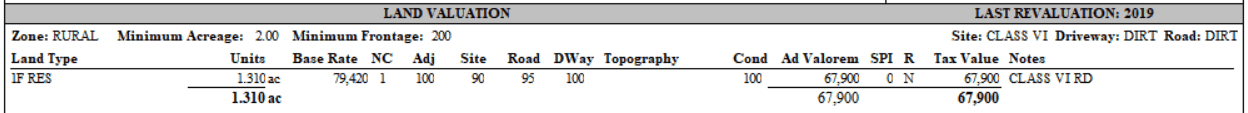

Class VI – Gravel – Brooks Road

Base $79,420; Assessment $67,900: -15%

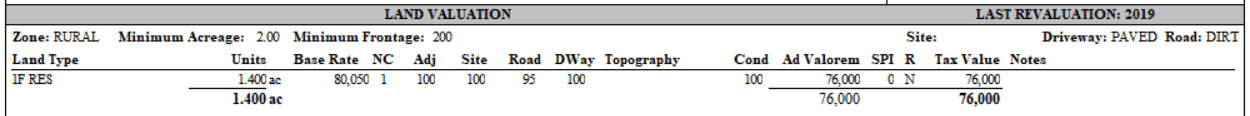

Class V – Gravel – Ross Road

Base $80,050; Assessment $76,000: -5%

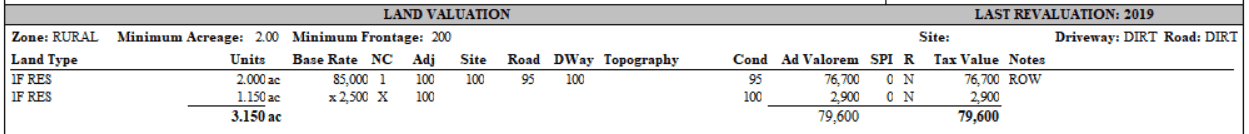

Private – Gravel – Carr Drive

Base $85,000; Assessment $76,700: -10%

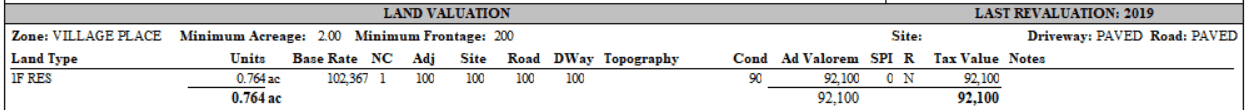

Private – Paved – Breezy Way

Base $102,367; Assessment $92,100: -10%

And followed with:

“The base rate for land values varies based on neighborhood and geographic location. That base rate is further adjusted based on the information I previously provided. The examples show how living on Class VI, private, and gravel roads affect the base rate of land assessments. This is a factual representation of Barrington’s assessing methods.”

“I understand that members of multiple communities have concerns regarding property assessments and services. My interest is in providing Barrington residents with factual information regarding our assessing methods. Our assessing methods take into consideration the class of the road and the road surface; that is important for residents to know. If another community does not do the same, that does not make them wrong and Barrington right; just different.”

While we hope to provide the most accurate information, we have not heard back from the New Hampshire Private Road Taxpayers Alliance regarding these communications that we shared with Mr. Allie. We hope to in the future determine what Mr. Allie was referring to when we used the word “claims” to describe information that we shared with him from the Town of Barrington.

For now, we have the following document available from the Town of Barrington entitled “2019 Revaluation - Frequently Asked Questions” for you to download and look over. When we hear back from Mr. Allie of the New Hampshire Private Road Taxpayers Alliance, we will publish his response to this information as well.